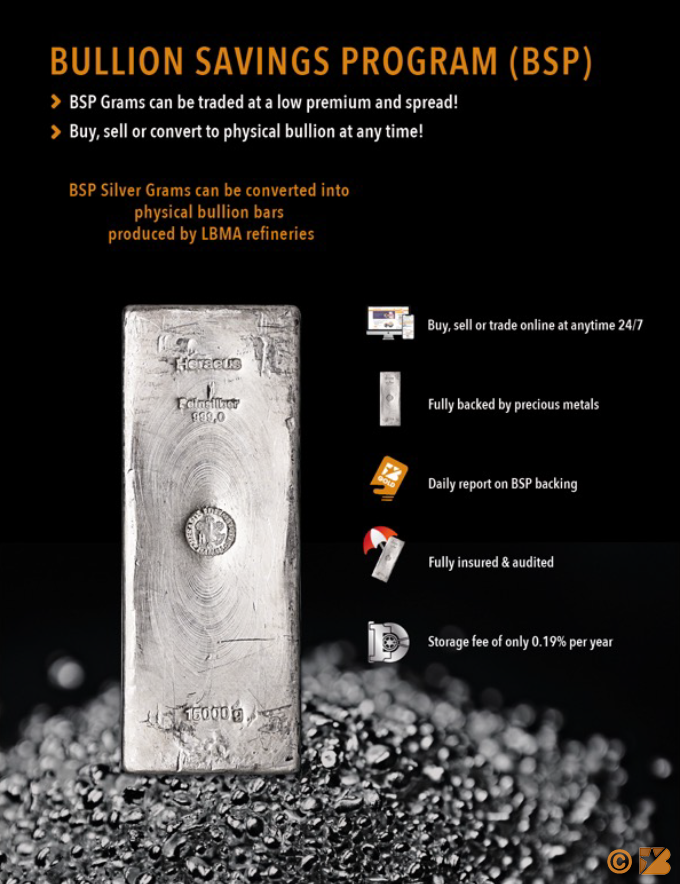

Buying & Storing Silver with BullionStar

BullionStar carries a wide selection of the most popular silver bullion coins and bars at some of the lowest prices in the industry. We also offer free U.S. shipping on all orders over $98. We carry American Silver Eagles, Canadian Maple Leafs, United Kingdom Silver Britannias, Australian Silver Kangaroos, South African Silver Krugerrand, and silver bullion bars from respected mints and refiners including the Royal Canadian Mint, Heraeus, Scottsdale Mint, Asahi, Nadir, and more. Another great option is the 1 Kilogram BullionStar No-Spread Silver Bullion Bar that can be traded with no spread between the buy and sell price.