How Mints Will Be Affected by Surging Bullion Coin Demand

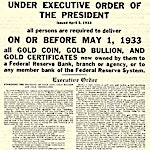

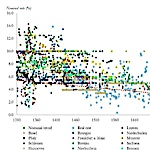

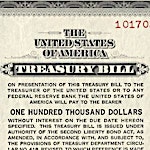

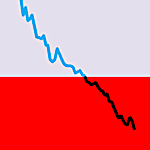

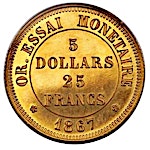

The demand for gold and silver coins has exploded as fears of COVID-19 sweep the globe. This post explores how this increase in coin demand is translated back to the producers of bullion coins, with a special focus on the U.S. Mint and Royal Canadian Mint. Continue Reading

JP Koning

JP Koning 3 Comments

3 Comments