LBMA a Deer in Headlights On Russian Gold Refiners Sanctions

Following first the threat of invasion and then the actual Russian invasion of Ukraine, a range of sanctions against Russia by a range of countries have inevitably been announced and rolled out.

UK Sanctions against Russia

On 22 February, the UK Government announced asset freezes against a range of Russian oligarchs and 5 Russian banks, namely Bank Rossiya, Black Sea Bank for Development and Reconstruction, IS Bank, Genbank and Promsvyazbank. At the same time the UK said it was introducing legislation to “prevent Russia from issuing sovereign debt on UK markets”.

Then on 24 February, after Russia invaded Ukraine, the UK Government rolled out further sanctions described as “punishing” and designed to “devastate Russia’s economy and target Vladimir Putin’s inner circle”, and which target a range of individuals, companies and financial institutions.

In the words of the UK Foreign Office, these sanctions include:

- Russian bank assets in UK to be frozen, totally shutting off its banking system from UK finance markets

- ban on Russian state-owned and key strategic private companies from raising finance on the UK financial markets

- punitive new restrictions on trade and export controls against Russia’s hi-tech and strategic industries

As regards financial institutions, the UK Foreign Office said that it will “freeze the assets of all Russian banks including a full asset freeze on VTB, Russia’s largest bank.”

Russian companies will be prevented from borrowing and raising finance on UK markets (i.e. banned from issuing transferable securities and money market instruments in the UK), while designated (sanctioned) banks will be prevented from accessing Sterling and clearing payments through the UK.

BREAKING: Boris Johnson announces “largest set of economic sanctions Russia has seen," including banning Russian banks from U.K. finance system, blocking Russian firms from raising finance in London and sanctions against over 100 individuals and entities https://t.co/ToCVAIl1eP pic.twitter.com/rkHaXNUytx

— Bloomberg UK (@BloombergUK) February 24, 2022

US Sanctions against Russia

In the United States, US Treasury’s Office of Foreign Assets Control (OFAC) also rolled out new economic sanctions against Russia on 24 February which:

“target the core infrastructure of the Russian financial system – including all of Russia’s largest financial institutions and the ability of state-owned and private entities to raise capital – and further bars Russia from the global financial system. The actions also target nearly 80 percent of all banking assets in Russia.”

This includes sanctions targeting Russia’s two largest banks, Sberbank (which according to the US treasury is “the largest financial institution in Russia and is majority-owned by the Government of Russia”) and the aforementioned VTB Bank, the goal being to block Sberbank’s and VTB’s global foreign exchange transactions and prevent these banks using correspondent banks around the world.

The US Treasury sanctions also specifically target a range of additional Russian financial institutions, namely, Bank Otkritie (Russian state-owned), Novikom (Russian state-owned), and Sovcombank (privately owned), Alfa Bank (privately owned), and Credit Bank of Moscow (privately owned), and in addition prohibit a total of 13 Russian financial institutions from raising new debt or equity capital on US financial markets.

Furthermore, the US sanctions also target 11 Russian corporate entities which have been identified as being Russian Government owned. These entities including Sberbank (again), Gazprombank, Gazprom (natural gas producer), Gazprom Neft (oil producer and refiner), Transneft (Russia’s network of petroleum-related pipelines), Rostelecom (telecommunications), and Alrosa (diamond mining).

European Sanctions against Russia

Across in Europe, the European Union (EU) has imposed its own set of sanctions against Russia, which in the economic / financial sector include assert freezes on Russian banks and blocking Russian access to capital markets and EU trading venues. This is a set of sanctions which in the words of the EU “will target 70% of the Russian banking market, and key state-owned companies, including in the field of defense”.

Disconnecting from SWIFT

On Saturday 26 February, a coordinated group comprising the US, European Commission, France, Germany, Italy, Canada and UK announced that they will disconnect a certain number of Russian banks from the very important SWIFT international interbank payments system. Its not clear yet which banks this refers to.

The wording of the EU statement says:

“we commit to ensuring that selected Russian banks are removed from the SWIFT messaging system” so as to “ensure that these banks are disconnected from the international financial system and harm their ability to operate globally.”

Belgian headquartered SWIFT, which stands for Society for Worldwide Interbank Financial Telecommunication, is a critical network for sending payments between banks worldwide, as well as executing all manner of financial transactions. Anyone who have ever sent a payment using a bank to anyone around the world will know intuitively that kicking Russian banks out of the SWIFT network will stifle their international functioning.

Those who have ever worked in a commercial / investment bank may also know the Swift MT standard, a messaging system which is used for all types of messaging in areas such as payments, trade finance, treasury transactions, FX, money markets, securities processing, cash management, and letters of credit. So any Russian banks excluded from the SWIFT network would lose access to MT messaging also.

Bigger Target – The Bank of Russia

As well as introducing SWIFT sanctions, this same group comprising the US, European Commission, France, Germany, Italy, Canada and UK have targeted Russia’s central bank, saying that they are committed to:

“imposing restrictive measures that will prevent the Russian Central Bank from deploying its international reserves in ways that undermine the impact of our sanctions.”

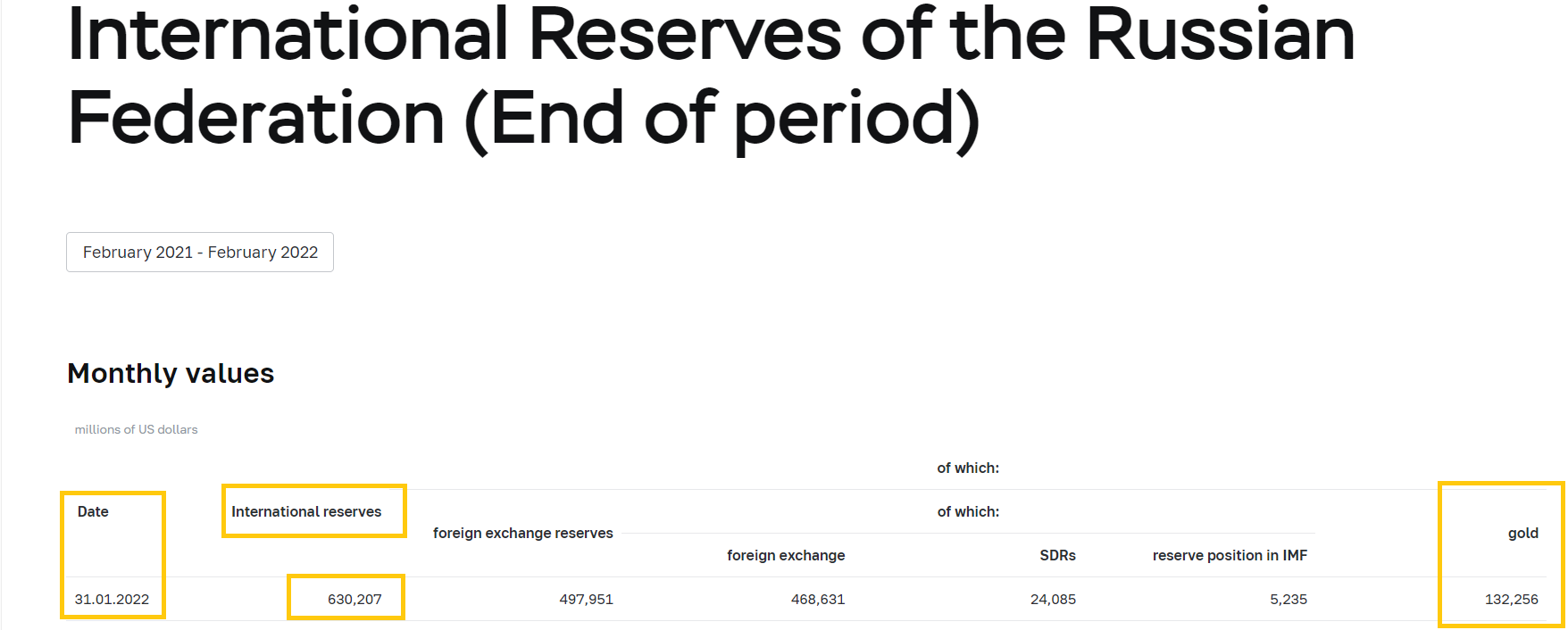

Russia’s latest international reserves can be seen on the Russian central bank’s website here. If that link doesn’t work (as the Bank of Russia website has been inaccessible at times), the Wayback machine has archived the Bank of Russia’s international reserves (as of Saturday 26 February) and can be accessed here.

As of 31 January 2022, the Russian central bank held international reserves worth US 630.207 billion, of which US 497.951 billion was in foreign exchange reserves and US$ 132.256 billion was in gold. This equates to 79% in foreign exchange reserves and 21% in gold. Of the foreign exchange reserves, most of this is normal ‘foreign exchange’, with a small portion listed as SDRs and Russia’s ‘reserve position in the IMF’. See screenshot below.

According to the Financial Times, the Bank of Russia’s foreign currencies comprise, in descending order of value, euros, US dollars, Chinese renminbi, pounds sterling and other currencies, so given the composition of these FX reserves, and given that it’s the US, UK and European Union who are doing the sanctioning, the Bank of Russia’s euros, US dollars and pounds which are held outside Russia on behalf of the Russian central bank are at imminent risk of being frozen.

The implications of freezing Russia’s foreign currency reserves are far reaching and are hampering the ability of the Bank of Russia to intervene in foreign exchange markets. The Russian rouble has again crashed . It will also impact domestic Russian bank liquidity and even bank solvency. Bank runs in Russia may now be imminent, as well as domestic flight to the US dollar.

Russian rouble tumbles to record low https://t.co/aexr9T4aW4 pic.twitter.com/MXM4mLkzGQ

— Reuters (@Reuters) February 28, 2022

Excluding the major Western currencies, this leaves the Russians with the Chinese renminbi as potentially accessible (assuming Chinese doesn’t bow to sanctions pressure). And it also leaves the Russian central bank with gold. A lot of gold.

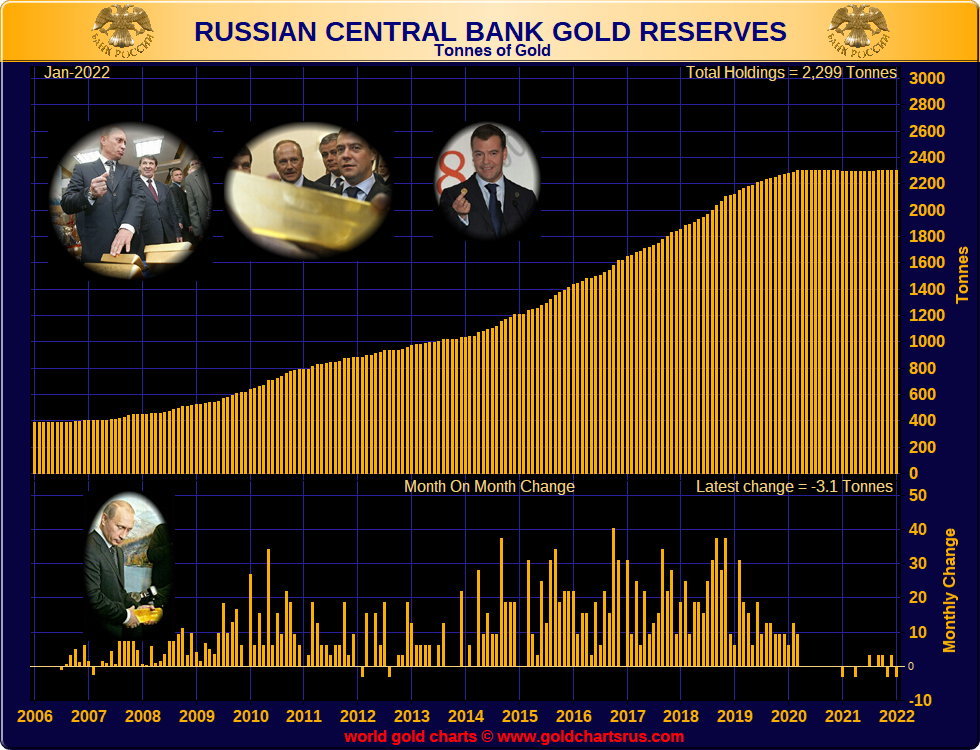

Russia, via the Bank of Russia, holds 2299 tonnes of physical gold, and is now the fifth largest sovereign gold holder in the world, after steadily accumulating most of this gold since 2008. Notably, in late 2007, the Russian central bank still only held about 400 tonnes of gold, so Russia’s gold stockpile has increased by 600% since 2008. See chart below.

Two thirds of Russia’s gold reserves are held in vaults on Pravda Street in Moscow, with the other third held in vaults in St. Petersburg and Yekaterinburg.

Bank of Russia – Selling or Buying Gold?

There is also the possibility that Russia holds more than 2299 tonnes of gold, as additional gold may be being held in both the Russian State Fund of Precious Metals and Precious Stones, operated by The Gokhran (see here), and also through Russia’s Sovereign Wealth Fund – see here.

In an article on Sunday 27 February, the Financial Times speculates that due to Western sanctions against the Russian central bank, the Bank of Russia might sell gold:

“The central bank could also try to sell a chunk of its 2,299 tonnes of gold, the fifth largest stockpile in the world, to friendlier governments. This gold is held in locations in the Russian Federation, according to the central bank.

But Sergei Guriev, an economist at Sciences Po university in Paris, said selling those reserves would also be difficult.

‘Whoever says it will be easy to sell gold or yuans must be kidding – Chinese state banks are already blocking financing of Russian oil sales. China is afraid and rightly so of secondary sanctions. This is really a game changer,’ he said.”

Surely though, the Bank of Russia wants to keep its strategic gold reserves and buy even more gold, not to sell some of its gold? Russia’s entire gold accumulation strategy has been preparing for a scenario such as now, where gold will become crucial to the geo-political chess game amid heightened conflict risk and sanctions risk.

The Bank of Russia appears not to have read the Financial Times, since according to Reuters, Russia just came out on 27 February and will do the opposite of what the FT suggested:

“Russia’s central bank on Sunday [Feb 27] said it would resume buying gold on the domestic market from Feb 28, as it undertakes measures to try and ensure financial stability during Western sanctions against Moscow for its invasion of Ukraine.”

From an above reading of the various sanctions against Russia by Western powers, the one thing that stands out is that none of the sanctions so far have specifically mentioned gold or access by Russia to the international gold markets.

Across the UK, US, and European sanctions, the common theme is freezing of bank assets, blocking the access of Russian banks and Russian companies to Western capital markets, sanctioning Russian government owned companies, banning various Russian banks from the SWIFT system, and attempting restrictive measures against the deployment of Russia’s international reserves.

While the “restrictive measures against the deployment of Russia’s international reserves” is interesting and could indirectly cover the ‘deployment’ of gold, given that all of Russia’s gold reserves held in Russian vaults, what exactly would ‘deploying’ mean when applied to the Russian gold?

LBMA quietly drops VTB and Otkrytie

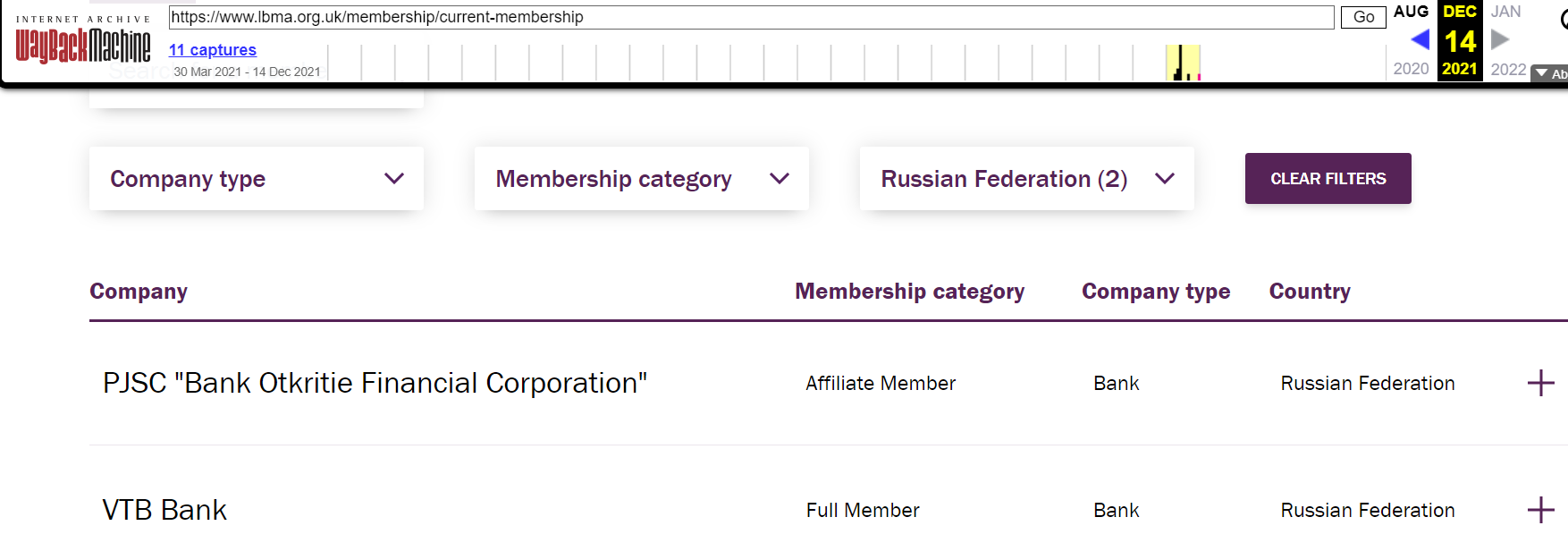

It looks like we are about to find out. Because quietly and without acknowledgment, the Western bullion bank dominated London Bullion Market Association (LBMA), has gone and dropped Russian banks from its currently membership list. This refers specifically to Russian banks VTB Bank (which was a full member of the LBMA), and Bank Otkrytie (which was an affiliate of the LBMA).

Since, if you go to the LBMA current membership list, and look for these banks, they are no longer there. There are now zero LBMA members from the Russian Federation.

But using the Wayback Machine (Internet Archive), you can see from its most recent imprint that in mid-December 2021, both VTB and Bank Otkrytie were listed as current LBMA members.

LBMA quietly drops Russia’s VTB Bank and Bank Otkrytie from its membership list, hoping no one will notice…. Previous list in screenshot. Current list here https://t.co/e4RA1VkZu4 pic.twitter.com/HCVXvxBGXh

— BullionStar (@BullionStar) February 27, 2022

VTB Bank had joined the LBMA as a full member in March 2015. Bank Otkritie Financial Corporation (Bank FC Otkritie), which was formerly known as Nomos Bank, had joined the LBMA as an associate in November 2011. But just like that, VTB and Otkritie have now disappeared, without any Sanctions statements mentioning anything about the LBMA or indeed about any gold market. Maybe an enterprising Bloomberg or Reuters reporter who wants to pick up the story can ask the LBMA for an explanation.

LBMA – Ignoring its own Rules

But there is more, because also in the last few days, the LBMA has quietly added a short item to its news page titled “Sanctions: Timely Reminder” in which it states that:

“Under LBMA Good Delivery Rules, all GDL Refiners are required to comply with UN, EU, US, UK, or any other relevant, economic and/or trade sanction lists. Breach of any of the relevant Sanctions list would lead to removal from the GDL. Removal can involve a suspension or permanent de-listing.

If suspended, the Refiner will be transferred to the Former List, the Bars that it produced while on the List will still be considered Good Delivery. LBMA reserves the right to de-list Bars after an appropriate period in cases where production has ceased.

We will alert all relevant stakeholders of any changes to the Good Delivery List. For status updates, please visit the Current Good Delivery List.”

Before looking at this statement from the LBMA about Good Delivery refiners, note that while the LBMA went to the bother of adding a statement to its website under the title of “Sanctions”, it conveniently failed to mention that 2 of its members, VTB Bank and Bank Otkritie, have now been excluded as members of the LBMA. This is a typical LBMA distraction technique. Look over here at the Good Delivery List, but not over there at the Membership list.

Now back to the Good Delivery statement. As a reminder, the LBMA Good Delivery Lists refer to gold and silver list refineries whose gold and silver bars meet the required standard for acceptability in the London bullion market.

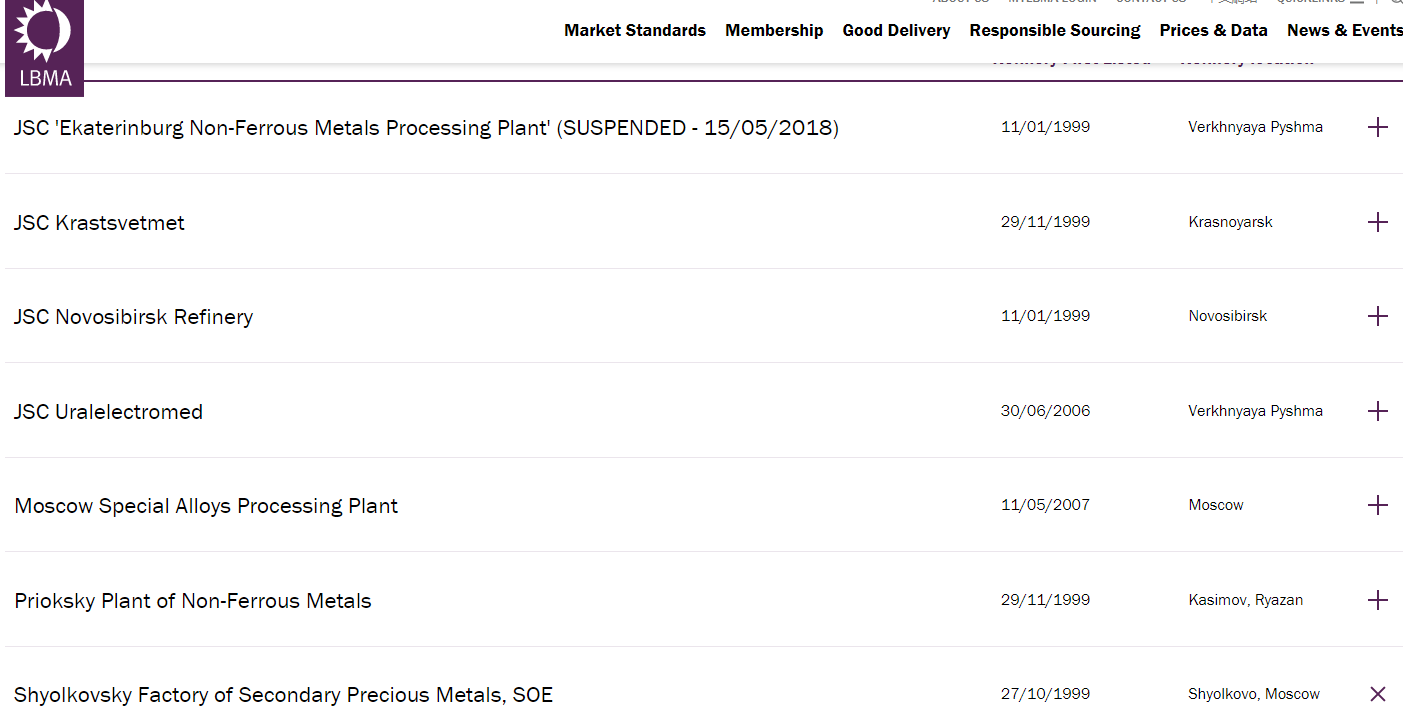

LBMA’s Russian Refineries

There are currently 6 Russian refiners listed on the LBMA current Good Delivery List for gold. These six refiners, using their short names, are Krastsvetmet, Novosibir, Uralelectromed, Moscow Special Alloys Plant, Prioksky and Shyolkosky.

There are currently 5 Russian refiners on the current LBMA Good Delivery List for silver, five of the same six as on the gold list, namely Ekaterinburg, Krastsvetmet, Novosibir, Uralelectromed, Prioksky and Shyolkosky.

In the latest version of the LBMA Good Delivery Rules, sanctions are addressed in Section 4, Compliance and Risk Management:

“4.4 Economic and Trade Sanctions

Bars must be capable of being delivered to, and held by, any person, including any person who falls within the definition of a US person identified in US sanctions, without violating any UN, EU, US, UK, or any other relevant, economic and/or trade sanction lists, or causing any person to violate any UN, EU, US, UK or any other relevant sanctions (collectively “Sanctions Rules”).

Refiners are to comply with all relevant economic/trade sanctions lists and are strongly advised to seek legal guidance where relevant.

Breach of any Sanctions Rules will lead to immediate removal from the List.”

Even a quick reading of these Good Delivery Rules suggests that all Russian refineries on the LBMA Good Delivery List are in breach of the LBMA’s own Good Delivery Rules. Why?

Because the Russian domestic gold market is an ecosystem in which the gold producers (miners) and gold refiners and the Russian commercial banks and the Russian central bank are all interconnected, and where commercial banks, such as Sberbank, VTB, Otkritie and Gazprombank sit in the middle, running the entire market. For details, see BullionStar’s Gold University article on the Russian Gold Market.

Russian banks such as Sberbank, VTB, Otkritie and Gazprombank buy the gold from the Russian gold mines, get the gold refined in the refineries such as Ekaterinburg, Krastsvetmet, Novosibir, Uralelectromed, Prioksky, and Moscow Special Alloys Plant, and then take delivery of the refined gold bars from the refineries and sell it on, including selling the refined gold bars to the Russian central bank.

All of these Russian banks are now on the sanctions lists. If Russian gold refineries do business with these Russian banks (which they have to do as the Russian banks are their clients), they will violate the UK – EU – US sanctions.

The Russian refineries, by also refining gold which then gets sold to the Russian central bank, will also then be facilitating the central bank in boosting and deploying its international reserve assets, which will too be in breach of the UK – EU – US sanctions. Then there is the issue of ownership of Russian gold refineries.

As the London Bullion Market Association (LBMA) suspends major Russian gold refinery Ekaterinburg (EZOCM) from its Good Delivery List due to ‘ownership issues’, the move appears politically motivated and undermines the LBMA’s supposed impartiality. https://t.co/j9TA21iP4q. pic.twitter.com/i3Wj21sRzx

— BullionStar (@BullionStar) May 17, 2018

Russian State Owned, LBMA Accredited

Back in May 2018, the LBMA ‘suspended’ one Russian refinery from its Good Delivery List. This refinery was Ekaterinburg, and according to Reuters, Ekaterinburg was suspended by the LBMA due to “ownership related issues”, essentially Ekaterinburg was controlled by Russian conglomerate Renova Group (headquartered in Moscow and with a subsidiary in Zurich) which was controlled by Russian oligarch Viktor Vekselberg.

The reason why this was a problem for the LBMA was that in April 2018, the US Treasury sanctioned Renova Group and Viktor Vekselberg, saying that:

“Renova Group is being designated for being owned or controlled by Viktor Vekselberg.

Viktor Vekselberg is being designated for operating in the energy sector of the Russian Federation economy. Vekselberg is the founder and Chairman of the Board of Directors of the Renova Group.”

In December 2019, the Renova Group sold 92% of Ekaterinburg, which is also known as EZOCM JSC, to a Russian company called Ural-Dragmet. Despite this sale, the LBMA still to this day has Ekaterinburg listed on the Good Delivery lists for gold and silver with the words ‘(SUSPENDED 15/05/2018)’.

But the important thing here is precedent. In 2018, the LBMA suspended Ekaterinburg due to its controlling entities Renova and Viktor Vekselberg being on a US Treasury sanctions list. So let’s look at the ownership of the other 6 Russian refiners on the LBMA Good Delivery Lists in terms of ownership.

LBMA refinery JSC Krastsvetmet is 100% Russian state-owned, as it is wholly owned by the Krasnoyarsk Region Administration of the Russian Federation. By the way, Krastsvetmet is Russia’s biggest gold refinery, and for example in 2018 Krastsvetmet refined 234 tonnes of gold (or 75%) out of a total of 314 tonnes of gold which was produced in Russia that year.

LBMA refinery Prioksky Non-Ferrous Metals Plant is wholly owned by the Federal Agency of Property Control on behalf of the Government of the Russian Federation.

LBMA refinery Moscow Special Alloys Plant is fully owned by the Russian Federal Government.

In fact, according to TASS News Agency in May 2019, the Governor of the Krasnoyarsk Region said that they were looking at the possibility of creating a holding company to unite these 3 LBMA refineries of Krastsvetmet, Moscow Plant of Alloys, and Prioksky Non-Ferrous Metals Plant, since they are all owned by the Russian Government.

Next up, LBMA refinery Novosibir (JSC Novosibirsk Refinery) was owned by the Russian Federation until 2017, when is was sold to a company called LLC Center of Property Management (or in Russian “ООО «Центр управления недвижимостью»”. Someone who speaks Russian may be able to trace back as to which property company made the purchase.

LBMA refinery Uralelectromed is owned by Ural Mining Metallurgical Company (UMMC), which is mainly owned by Russian billionaire oligarch Iskander Makhmudov (who is president of UMMC).

And lastly, there is LBMA refinery Shyolkovsky (full name Shyolkovsky Factory Of Secondary Precious Metals, and also known as Shchelkovo VDM). Its website is here.

In 2017, “a block of shares in JSC Shchelkovo Secondary Precious Metals Plant was sold at auction to JSC Novye Tekhnologii for 1 billion 515 million rubles. This was reported by the press service of the Auction House of the Russian Federation (RAD)”

The Shyolkovsky website says that:

“Since April 2017, the main partner of the Joint Stock Company ‘Shchelkovsky Plant of Secondary Precious Metals’ is the Joint Stock Company ‘Yuzhuralzoloto Group of Companies’”.

Yuzhuralzoloto (aka Uzhuralzoloto) was founded by Russian billionaire Konstantin Strukov, The Shyolkovsky website also says that “Our partners: jewelry factories, banks, defense, chemical and other industries.” And there is a large and prominent LBMA logo on the homepage of the Shchelkovsky website here.

LBMA, LPPM, Platinum and Palladium

Note too that the LBMA also administers the London Platinum and Palladium Market (LPPM), and there are two Russian refineries on both the current LPPM Good Delivery List for Platinum and the LPPM Good Delivery List for Palladium, namely “The Gulidov Krasnoyarsk Non-Ferrous Metals Plant” and the “Prioksky Plant of Non-Ferrous Metals” (a.k.a. Krastsvetmet and Prioksky).

The CME Group which runs COMEX should also take notice, since after the CME mass approved 267 LBMA Gold and Silver refineries in August 2020 and added them to its COMEX accepted refiner list, the bars of every Russian precious metal refiner mentioned in this article are now approved for trading on COMEX. See “LBMA-COMEX collusion intensifies as CME approves 267 LBMA gold and silver bar brands" for details.

SPDR Gold Trust’s Russian Bars

You will note from the LBMA’s ‘Sanctions – Timely Reminder” statement, that it says:

“If suspended, the Refiner will be transferred to the Former List, the Bars that it produced while on the List will still be considered Good Delivery”.

Why would the LBMA be so keen to point this out, and fixated that Russian bars, if transferred to Former Good Delivery would still be considered Good Delivery? Maybe it’s because there are nearly 1000 Russian 400 oz gold bars currently being held in the famous SPDR Gold Trust (GLD) in a vault in London (,either in the HSBC custodian vault or the Bank of England sub-custodian vault).

If you open the GLD bar list pdf and scroll to page1629, and then scroll down through to page 1646, see will see that the SPDR Gold Trust holds a huge number of gold bars from LBMA Russian refiners Novosibir, Prioksky, Krastsvetmet, Uralelectromed, I wonder how many GLD hedge fund and institutional investors know this? While gold bars from suspended Russian gold refineries may still be good delivery in the eyes of the LBMA, this is not the case in the eyes of traders.

Looking back to May 2018 at the time of Ekaterinburg’s suspension, Reuters said the following:

“Suspension from the list makes it harder for buyers and sellers to trade bars in the mainstream precious metals market, traders said.

‘"Our company would not touch any bars that are not LBMA-accredited,’ one trader at a major precious metals house said. ‘Most probably they are going to be in a secondary market.’

While today the UK Gov imposed a huge list of sanctions against Russian banks, companies & elites, the LBMA still has 6 Russian gold refineries on its LBMA Good Delivery List. This is odd given that in 2018, the LBMA suspended 1 Russian gold refinery due to ‘ownership issues’.

— BullionStar (@BullionStar) February 24, 2022

Conclusion

Events are running rapidly, and the coming week will be crucial to see how Russia and the Bank of Russia reacts to the SWIFT exclusions, and how the Bank of Russia will leverage its monetary gold reserves. Will Russia now accept gold for oil. What role will China play in all of this? Is the demise of the US dollar as world reserve currency at hand? Is the demise of the London fractional reserve paper trading gold system at hand?

In light of all of these new US – EU – UK sanctions against Russian banks, Russian state owned and strategic private Russian companies, and Russian oligarchs, I would say the LBMA has a major headache on its hands in the coming week as regards the LBMA Russian refineries.

But don’t worry, because, according to Reuters in May 2018, LBMA CEO Ruth Crowell said that “due diligence in regard to the credibility of the lists is continuously reviewed on an ongoing basis”.

Why did the LBMA issue an empty statement on 24 February titled “Sanctions: Timely Reminder” which didn’t even mention the word Russia, didn’t mention that VTB and Otkritie are no longer LBMA members, and didn’t mention any of the 6 LBMA Russian Good Delivery refiners? Because I looked up all of that information about these Russian refineries in less than an hour and matched it against the US – UK – EU sanctions, and if I can do that, so can the LBMA. But perhaps the LBMA is too busy organising conferences.

Popular Blog Posts by Ronan Manly

How Many Silver Bars Are in the LBMA's London Vaults?

How Many Silver Bars Are in the LBMA's London Vaults?

ECB Gold Stored in 5 Locations, Won't Disclose Gold Bar List

ECB Gold Stored in 5 Locations, Won't Disclose Gold Bar List

German Government Escalates War On Gold

German Government Escalates War On Gold

Polish Central Bank Airlifts 8,000 Gold Bars From London

Polish Central Bank Airlifts 8,000 Gold Bars From London

Quantum Leap as ABN AMRO Questions Gold Price Discovery

Quantum Leap as ABN AMRO Questions Gold Price Discovery

How Militaries Use Gold Coins as Emergency Money

How Militaries Use Gold Coins as Emergency Money

JP Morgan's Nowak Charged With Rigging Precious Metals

JP Morgan's Nowak Charged With Rigging Precious Metals

Hungary Announces 10-Fold Jump in Gold Reserves

Hungary Announces 10-Fold Jump in Gold Reserves

Planned in Advance by Central Banks: a 2020 System Reset

Planned in Advance by Central Banks: a 2020 System Reset

China’s Golden Gateway: How the SGE’s Hong Kong Vault will shake up global gold markets

China’s Golden Gateway: How the SGE’s Hong Kong Vault will shake up global gold markets

Ronan Manly

Ronan Manly 0 Comments

0 Comments