Polish Central Bank Airlifts 8,000 Gold Bars From London

In early July, BullionStar covered the notable news from Poland’s central bank, that it had boosted its monetary gold reserves to 228.6 tonnes by buying 125.7 tonnes over the 2018-2019 period, with a staggering 100 tonnes of this total purchased at the Bank of England in London during the first half of 2019.

Not only that, but as part of its announcement, the central bank, National Bank of Poland (NBP), also stated that following its new gold accumulation, it was planning to repatriate (or bring back) about 100 tonnes of this gold from London to NBP Treasuries in Poland. This was also, according to the NBP, after Polish central bank employees had inspected the Polish gold and its storage arrangements at the Bank of England in June of this year. See “Poland joins Hungary with Huge Gold Purchase and Repatriation” for details.

From the original Polish central bank press release (5 July), and translated from Polish to London:

”Due to the significant increase in our gold resources and taking into account the practice of other central banks, the Management Board of the NBP decided to transfer half of the current gold resources (about 100 tonnes) to the treasury of the NBP. The operation has already been communicated to our partners in the Bank of England and will be carried out in accordance with the schedule ensuring the security of this operation.”

Said NBP President Adam Glapiński at the time:

“By implementing our constitutional, statutory and simply patriotic commitment [to buy and repatriate gold], we not only build the economic strength of the Polish state, but also create reserves that will safeguard its financial security.

Airlifted to Freedom

Fast forward to November, and on Monday (25 November), the Polish central bank announced, in a press conference hosted by NBP President Adam Glapiński, that its gold repatriation operation has now been fully completed, and that exactly 100 tonnes of the Polish gold has been transported from the Bank of England in London to NBP Treasuryies in Poland.

According to the latest NBP press release – translated from Polish:

“The operation of transporting gold to Poland took place by air. A total of eight flights were made, transporting one thousand bars in each flight. The transport of gold was carried out by an international company specializing in the transport of monetary valuables, selected by way of a National Bank of Poland award procedure.

The whole operation went smoothly. During its implementation, there were no events affecting the safety of persons and cargo. Many people were involved in the implementation of the task, representing the National Bank of Poland, the Police, Border Guards, Airports, airport ground handling companies, as well as the Bank of England, a transport company and the British police.”

The NBP is so excited with the repatriation that it even plans a special commemorative gold coin to celebrate the occasion:

“To commemorate the return of gold to Poland, the NBP will issue a gold bar-shaped collector coin in December.“

We now also know who the specialist transport company responsible for the gold repatriation operation was, because it too has just issued its own press release (28 November), and it is none other than G4S International Logistics (G4Si).

Night Moves

The G4Si press release, titled ”How billions in gold was secretly moved from London to Poland”, also fills in some of the gaps not elaborated on by the National Bank of Poland, revealing that:

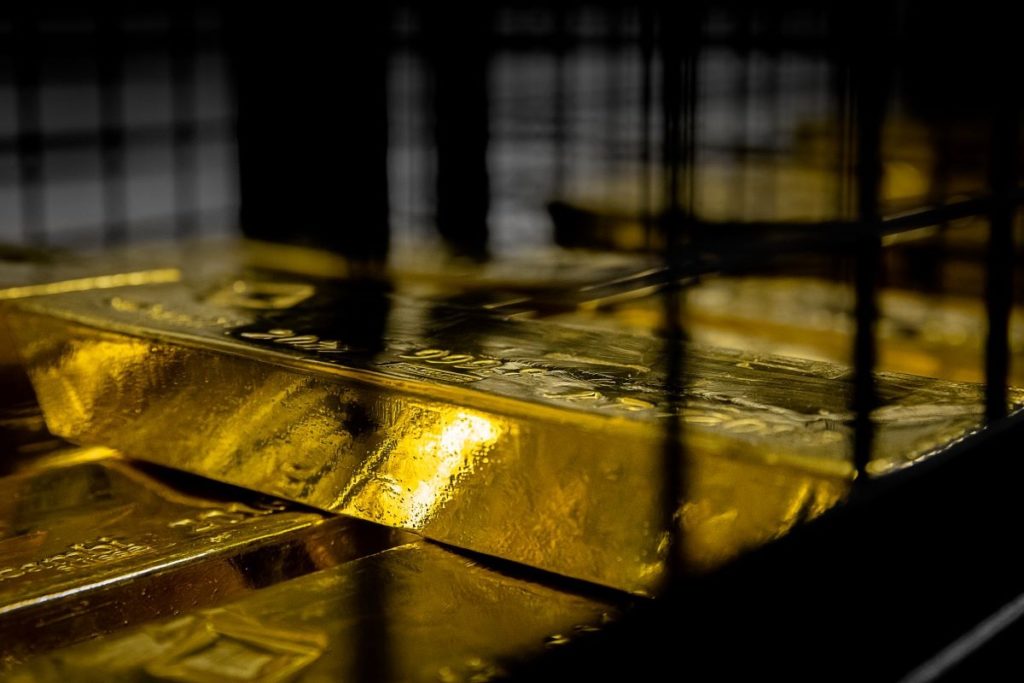

• Poland’s 100 tonne gold repatriation consisted of 8 air transfers from London to Poland, consisting of 1000 gold bars in each airlift, making 8000 bars in total, and worth $5 billion in total.

• Each of these gold bars is London Good Delivery bars, which weigh around 12.5kg each, with each bar stamped a serial number and refinery mark.

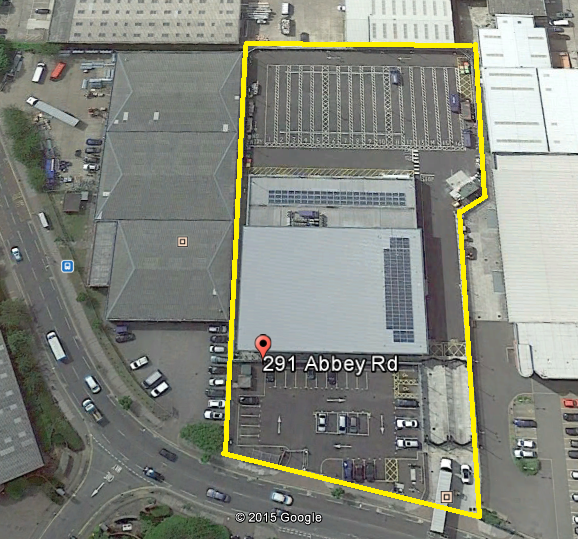

• The gold bars were transferred in armoured trucks from a G4S gold vault in northwest London (see below) to a London airport, under police escort in the middle of the night, with helicopters in support above.

• The last gold transfer out of London began in the early hours Friday 22 November (i.e. just last week).

• Although the gold seems to have come from the vaults of the Bank of England, it made an interim stop in the G4S vault facility where ”8,000 bars were carefully counted, prepared and packaged at a purpose-built G4S gold storage facility in London”.

• The flights from London to Poland used cargo planes, at least the last one did, which was a Boeing 737 freighter.

• Each transfer (of 1000 god bars) consisted of 20 heavy wooden boxes.

• On the Polish side, two airports were used to receive the flights.

• Each gold shipment, when it arrived at a Polish airport, was split between 3 armoured vehicles.

• These vehicles were again accompanied by full police motorcade escort to the Polish central bank vaults. G4Si described the police as elite police force officers. “Every precaution was taken to ensure the gold arrived safely,” said a G4Si employee. “We stopped at no traffic lights."

Phew! That’s an awful lot of trouble to go to for a Pet Rock, as the Wall Street Journal calls it. Motorcades, elite police, helicopters, jumbo jets, and top secret night convoys! But maybe the Wall Street Journal doesn’t know what its talking about, or more likely has an editorial policy to bash the yellow metal without ever asking any serious questions about the working of the gold market.

A not so secret ‘Secret Location’

At times, this G4Si press release reads like a film script doing the rounds of film studios. For example:

”In the early hours of the morning on November 22, 2019, four G4S trucks raced from a secret facility northwest of London carrying a special cargo. They were accompanied by a police escort, with a helicopter flying overhead. Lights flashed as they drove to a London airport, where 20 heavy, wooden boxes were carefully loaded and tied down in a Boeing 737 freighter plane.”

But in fact, there is nothing secret about the G4Si facility in northwest London, because its located at 291 Abbey Road, London NW10 7SA in a district of London called Park Royal. This is where G4S built a gold vault for Deutsche Bank in 2013-2014 and whose lease was then taken over by ICBC Standard bank in 2016. Park Royal is about 10 miles west of the Bank of England and about 12 miles north-east of Heathrow Airport. So the gold was moved from the Bank of England to Park Royal, and then on to the airport, presumably London Heathrow Airport. Park Royal, and outer London in general, is always full of traffic jams during the day, hence the need to transport the gold to the airport at night.

Big but not that big

G4S also describe the Polish gold repatriation as “one of the biggest private movements of gold between banks in the world.” While the Polish gold transport operation is indeed sizable, its not the biggest in recent times, since other gold repatriations have been larger. For example:

The Netherlands central bank (or the NYFed) moved 122.5 tonnes of gold from the Federal Reserve Bank of New York to Amsterdam in 2014. See here for details.

The German Bundesbank initiated a transfer of 674 tonnes of gold from Paris (274 tonnes) and New York (300 tonnes) over 2013-2017. Admittedly that was a ridiculously long time-frame but it did include transfers of over 100 tonnes each from Paris and New York in both 2015 and 2016. See here for details.

On behalf of the Venezuelan central bank, various bullion banks and the Bank of England flew 160 tonnes of Venezuela’s gold to Caracas over a two month time-frame between the end of November 2011 and the end of January 2012. See here for details. (Some might also point to the mammoth 940 tonne transfer of gold from the Bank of England to Frankfurt over 2000-2001 but that’s another story).

And the Austrian central bank repatriated 90 tonnes of gold from London to Vienna over the summer of 2018. See here for details.

Therefore this Polish gold transfer, while not the largest, is up there with some other large gold repatriation transactions.

Conclusion – Easy as 123

Finally, back in July we pointed out that it was very coincidental to say the least that Poland had bought 100 tonnes of gold at the Bank of England during the first half of 2019 and also wanted to repatriate ‘about 100 tonnes’ of gold to Poland:

“Having bought 100 tonnes of gold at the Bank of England this year, and now wanting to repatriate 100 tonnes, the question then arises, are the recent purchases of 100 tonnes the only gold the Polish central bank really has access to in London, with the rest in some way encumbered and unavailable?”

That question still stands, and is even more pertinent now given that the National Bank of Poland has now transferred exactly 100 tonnes of gold to Poland. So where is the rest? The latest NBP press release says that “currently, the NBP holds 228.6 tonnes of gold, of which 105 tonnes are stored at the National Bank of Poland“. So that’s 105 tonnes safe and secure and held by Poland. But as Polish central bank president Glapiński said at his press conference this week, “half of the reserves, 123 tonnes, remain in England“.

If the Poles are serious that their central bank"build the economic strength of the Polish state" and “create reserves that will safeguard its financial security", they should maybe hold off on their commemorative gold coin issue for the moment and first find out where exactly is this 123 tonnes of gold that is supposedly at the Bank of England. For something in all of this doesn’t smell right.

Some enterprising Poles may therefore want to ask the NBP to undertake a full physical audit of this 123 tonnes of gold, publish a full audit report, publish a full weight list of the gold bars in London (with refiner serial numbers), and publish a full disclosure of whether and how much of this 123 tonnes of gold is held in allocated form and how much is lent, loaned, pledged, or encumbered in any shape or form. That level of detail is easy for the Bank of England to produce and would indeed be worthy of a commemorative gold coin, but something tells me the central banks in question will not want to cooperate.

Popular Blog Posts by Ronan Manly

How Many Silver Bars Are in the LBMA's London Vaults?

How Many Silver Bars Are in the LBMA's London Vaults?

ECB Gold Stored in 5 Locations, Won't Disclose Gold Bar List

ECB Gold Stored in 5 Locations, Won't Disclose Gold Bar List

German Government Escalates War On Gold

German Government Escalates War On Gold

Polish Central Bank Airlifts 8,000 Gold Bars From London

Polish Central Bank Airlifts 8,000 Gold Bars From London

Quantum Leap as ABN AMRO Questions Gold Price Discovery

Quantum Leap as ABN AMRO Questions Gold Price Discovery

How Militaries Use Gold Coins as Emergency Money

How Militaries Use Gold Coins as Emergency Money

JP Morgan's Nowak Charged With Rigging Precious Metals

JP Morgan's Nowak Charged With Rigging Precious Metals

Hungary Announces 10-Fold Jump in Gold Reserves

Hungary Announces 10-Fold Jump in Gold Reserves

Planned in Advance by Central Banks: a 2020 System Reset

Planned in Advance by Central Banks: a 2020 System Reset

A Silent Gold Revolution: The New Gold Price Breakout

A Silent Gold Revolution: The New Gold Price Breakout

Ronan Manly

Ronan Manly 0 Comments

0 Comments