Gold Gains Hugely in Popularity Among American Investors

Gallup, the Washington DC analytics and surveying firm, recently released the findings of its annual ‘Economy And Personal Finance’ survey which asks the US public the simple question “Which investment asset class do you think is the best long-term investment?“.

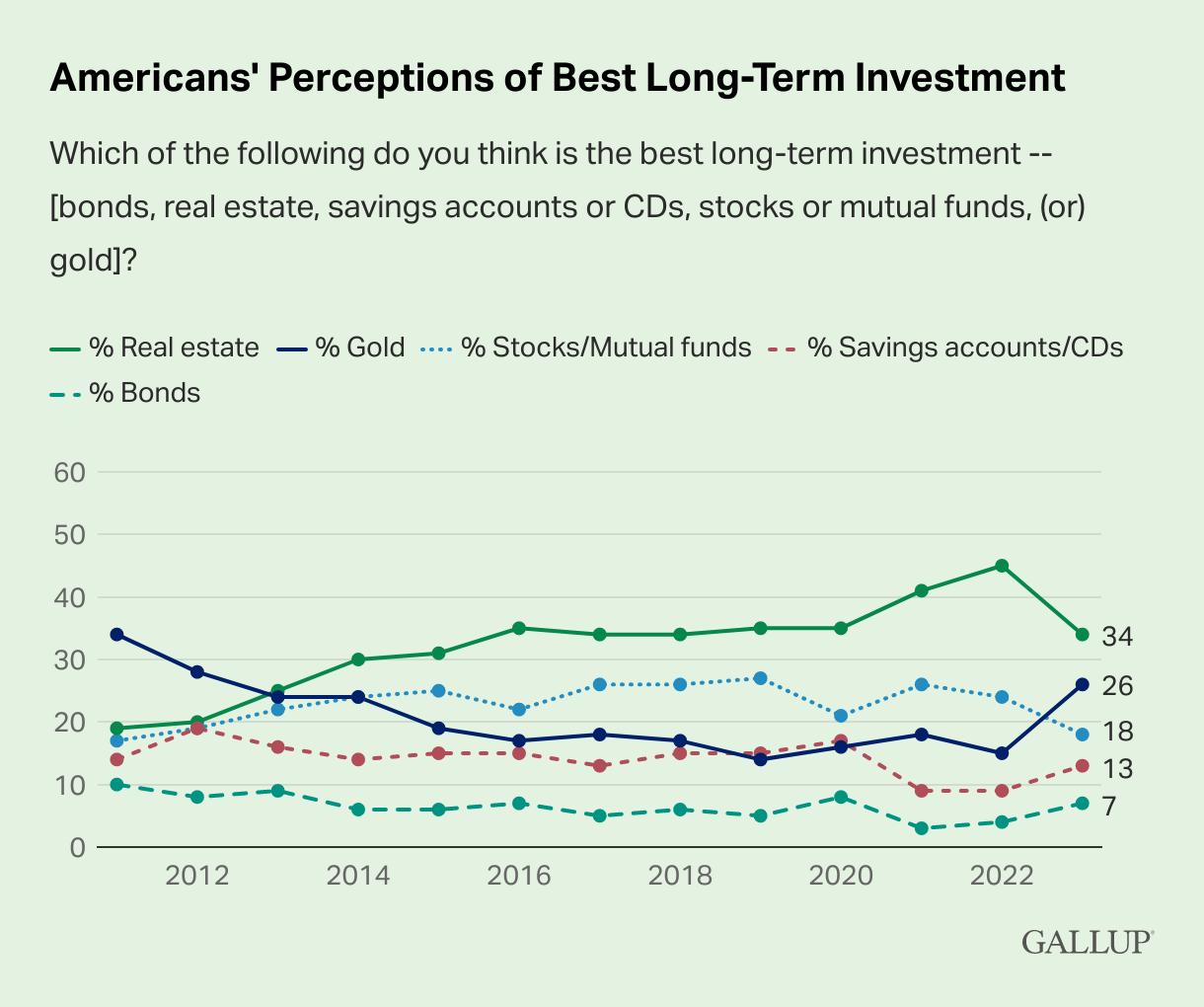

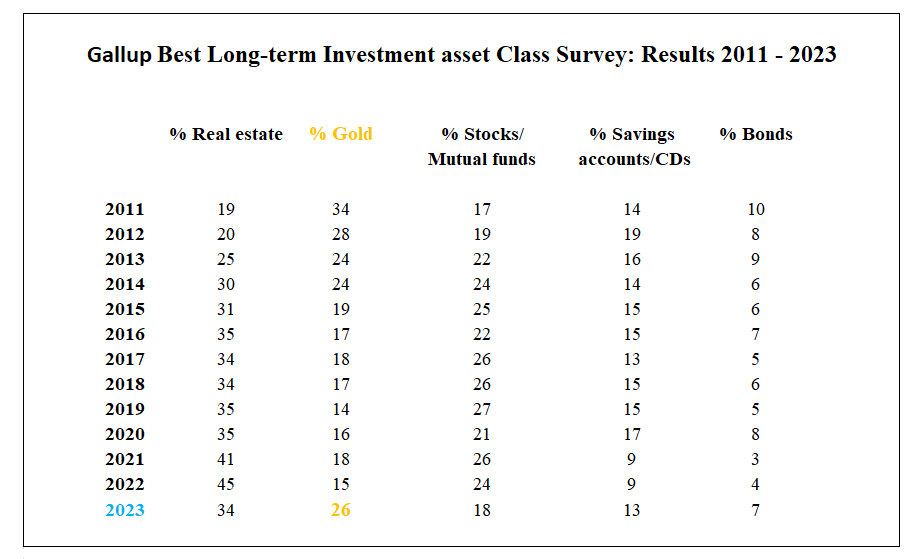

And the results of the 2023 survey are extremely encouraging for gold, with 26% of survey respondents saying that they perceive gold to be the best long-term investment.

This 26% score for gold in 2023 is nearly double the 15% of respondents who opted for gold as the best long-term investment in the 2022 survey, and reinforces evidence seen elsewhere that there is an ongoing massive shift in gold’s favor among the US public right now.

Not only that, but the percentage of Americans opting for gold as the best long-term investment was also the highest result for gold in the annual poll since 2012, when 28% of the US public opted for gold. This means that the percentage of the US public who think gold is the best long-term investment is now at its highest for 11 years.

Not surprisingly, this shift to gold is occuring in a US economy which has experienced multi-year high inflation, heightened stock market volatility, multiple large bank failures such as Silicon Valley Bank and Signature Bank, and a general sense of heighted geo-political and financial market risk.

The Background

Each year, Gallup News Service conducts an “Economy And Personal Finance” poll within its Gallup Poll Social Series which asks the question:

“Which of the following do you think is the best long-term investment: bonds, real estate, savings accounts or CDs, stocks or mutual funds, or gold?”

The survey is conducted on a random sample of just over 1,000 adults (18 years +), living in all 50 US states and the District of Columbia, via telephone interviewing over landlines and cellphones, with the results weighted by national demographics.

The sequence of the five asset classes listed are rotated when the actual question is asked to respondents, so as to remove potential bias of one asset being mentioned in the question before another.

For many years up until 2010, this annual Gallop survey only included the four asset classes of real estate, bonds, savings accounts / CDs, and stocks / mutual funds, but in 2011 for the first time Gallop added ‘Gold’ as an asset class, which means that for the last 13 years, gold has been one of the five asset classes in the survey.

Additionally, last year in 2022, Gallup added a sixth asset class, namely cryptocurrency, to the survey, but decided to still keep the five asset classes as one version of the question, while making the ‘six asset classes’ another version, which means that for the last 2 years, the poll has two alternative questions:

Version A – “Which of the following do you think is the best long-term investment: bonds, real estate, savings accounts or CDs, stocks or mutual funds, or gold?”

Version B – “Which of the following do you think is the best long-term investment: bonds, real estate, savings accounts or CDs, stocks or mutual funds, gold, or cryptocurrency?”

Given 2 different questions, Gallup handles this by splitting the sample of respondents into two, and asking approximately half the people Version A of the question, while asking the remainder of the people Version B of the question.

This year in 2023, the random sample consisted of 1013 adults, with 500 people asked the question about five asset classes, and the remaining 513 people asked the question about six asset classes. A partner company of Gallup called Dynata, which is a customer data supplier company, provided the respondent contact data that Gallup then polled.

Importantly, this 2023 Gallup survey took place between April 3 and April 25, 2023, so it is extremely recent. The full survey results can be seen in pdf form here.

Gallup says that these sample sizes have a “margin of sampling error is ±5 percentage points at the 95% confidence level”, which basically means that there is a 95% level of confidence that the reported percentages (of preferences for different long-term investments) from the sample of US adults are within ±5 percentage points of the true percentages of preferences in the entire US population.

The Findings

Overall, the 2023 Gallup poll found that 34% of Americans think that real estate is the best long-term investment, followed by 26% of Americans who think that gold is the best long-term investment.

In third place came stocks / mutual funds, which only 18% of the US public right now consider the best long-term investment, and in fourth place came savings accounts / certificates of deposit (CDs) with 13% of respondents opting for this asset class as the best long-term investment. Note that CDs are time deposits. Rounding out the results was bonds, with only 7% of respondents thinking that bonds are currently the best long-term investment.

Given that any poll / survey uses a sample and comes up with an estimate, all polls, including this one, are subject to sampling variability. And remembering the sampling error of ±5 percentage points in the sample sizes of 500 people (as stated by Gallup), the results can be interpreted as follows:

Taking the gold response percentage of 26% as an example, this means that we can be reasonably confident (95% confidence) that the true percentage of the US population who thinks that gold is the best long-term investment falls within the range of 21% to 31% of the US population. In other words, between more than one fifth of American adults, and nearly one third of American adults, in April 2023 preceived that gold is the best long-term investment.

The Comparisons

The 2023 responses become even more interesting when compared to the findings of previous years’ Gallup surveys on the best long-term investment.

Lat year when the poll was condicted in April 2022, a substantial 45% of respondents thought that real estate was the best long-term investment. Given that real estate has now fallen to 34% in the 2023 survey, this is a massive drop in consumer sentiment towards the US real estate market and shows how higher US interest rates, applied by the US Federal Reserve, have really started to erode confidence in this sector of the US economy.

Remember that from the middle of March 2022 to early March 2023, Jerome Powell and the US Fed raised interest rates a massive 9 times, 8 of which took place after the 2022 Gallup poll was conducted and before the Gallup 2023 poll was conducted.

These interest rate hikes have had a huge negative impact on the US Public’s perception of real estate as a long-term investment. And also remember that the Fed again hiked a 10th time on May 3, which will only have dented this sentiment further. In total, the Fed went from practically a zero level of Fed Funds rates to over 5% in just over one year.

Critically though, these interest rate hikes did not have a negative impact on the US Public’s perception of gold as a long-term investment. On the contrary, during this time when the Fed has hiked massively, the US Public has nearly doubled it’s positive perception of gold as the best long-term investment.

The mainstream financial media will misleadingly try to insist that higher interest rates are ‘bad’ for gold. But what the MSM solely focuses on is spot and futures paper ‘gold prices’ which are created by City of London and Wall Street investment banks trading financialized and synthetic unallocated (gold credit) and cash-settled futures, prices are traded as ‘screen gold’ against the USD (ie. the XAU.USD pair) and whose prices are ‘painted’ by the banks’ trading desks, prices which are totally disconnected from the physical bullion market.

These Gallup 2023 results are saying the opposite. These results are saying that despite higher interest rates, a growing percentage of the ordinary American public are identifying gold as the best long-term investment, because they, as a group, believe that gold is financial insurance, a store of value and an inflation hedge.

Could it be that Main Street America senses an impending financial crisis and senses that higher Fed interest rates are not fixing the inflation problem and are in fact tipping the US into a likely recession and possible banking crisis? Remember that the average American on Main Street is far more savvy than the elite of Wall Street would like to admit, because the average American sees and experiences the US economy on a daily basis, unlike the detached elites in the towers of lower Manhattan.

Stocks Rout

While gold in 2023 has gained ground at the expense of real estate, gold has also gained ground at the expense of stocks / mutual funds.

Whereas this year in 2023, 18% of respondents said stocks or mutual funds were the best long-term investment, the corresponding figure in 2022 was 24%. Which means that this year, a full 6 percentage points less of respondents think stocks are a better long-term investment than last year.

The fall in positive sentiment towards the stock market can be attributed to the sharp falls in US equity prices over much of 2022, which, while having recovered some ground more recently, still had an impact on stock market perception when the 2023 survey was carried out in April. In fact, 18% is the lowest reading for stocks / mutual funds since 2011, a full 12 years ago.

While both savings accounts/CDs and bonds were chosen by relatively small percentages of poll respondents in 2023, with 13% and 7% respectively, these percentages were actually higher than in 2022, when only 9% of respondents chose savings accounts/CDs and only 4% indicated bonds as the best long-term investment.

So, as well as gold gaining ground in 2023, both savings accounts/CDs and bonds have also gained ground at the expense of real estate and stocks, as savings accounts and bonds are no doubt considered ‘safer’ alternatives to real estate and stocks by the retail US public.

Crypto Contagion: Luna -> 3AC -> Voyager -> Celsius -> FTX / Alameda – BlockFi – Exchanges – Hedge Funds – Lenders – Genesis – Silvergate – ??? pic.twitter.com/a0NNKcGcAK

— BullionStar (@BullionStar) November 18, 2022

Crypto Collapse

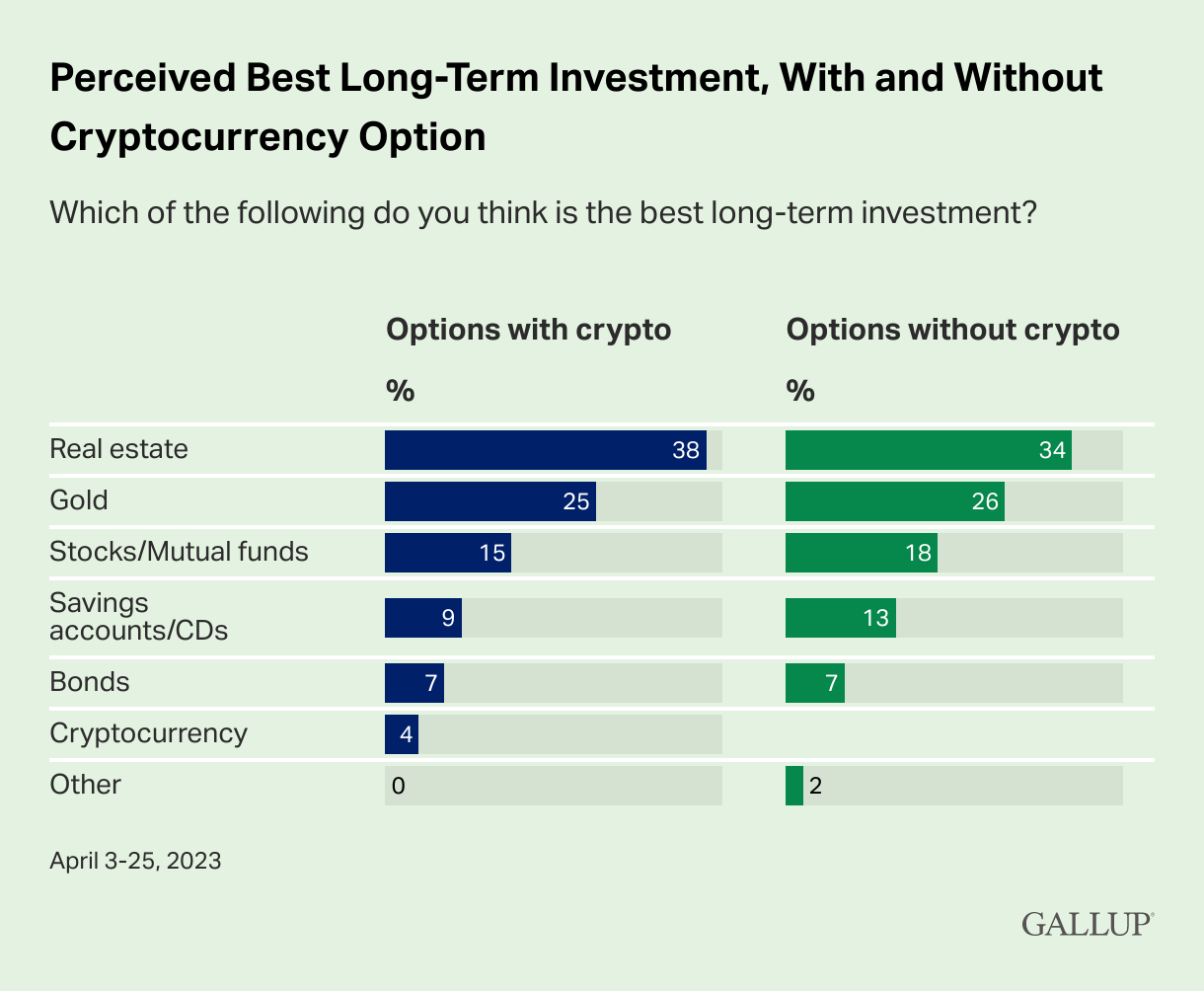

Turning to cryptocurrencies, as mentioned above crypto has only been an option in these Gallup surveys for the last 2 years, and in both years Gallup added crypto to Version B of its question along with the five other asset classes. So what did Gallup find as regards cryptocurrencies?

In the 2023 survey a very small 4% of respondents perceived that cryptocurrencies are the best long-term investment. This was down from 8% in the 2022 survey. This was also over six times less than the 25% of respondents who opted for gold as the best long-term investment i n 2023 (when including crypto in the asset class choices).

This is not surprising given the huge volatility and massive price falls across crypto coins and tokens for much of 2022, as well as the collapse of entities such as Luna, 3AC, Voyager and Celsius and major crypto exchange FTX in late 2022, and the collapse of various crypto friendly US banks in March 2023 (e.g. Silver Gate and Silicon Valley Bank).

With the US SEC how going after the world’s largest crypto exchange Binance and attempting to define many cryptocurrencies as securities, there is little short term hope that the image of cryptocurrencies as a ‘best long-term imvestment‘ will improve any time soon.

With cryptocurrencies in the mix in the Gallup question and chosen by only 4% of respondents, this naturally altered the chosen percentages slightly for the other five asset classes in the 2023 survey, with real estate chosen by 38% of respondents as the best long-term investment, gold by 25% of respondents, stocks by 15%, savings accounts/CD by 9%, and bonds by 7%.

In late 2021, the World Gold Council commissioned a survey by Hall & Partners of 10,000 retail gold and crypto investors across the five markets of the US, Germany, Canada, India and China to find out their views on gold and crypto as investments. While this was a five country survey, the findings clearly apply to the US market and starkly illustrate the differing perceptions of investors towards gold and crypto.

The Hall & Partners survey found that a full one third of crypto investors perceived their crypto investment as either ‘high risk with the potential for high returns’ or as a ‘purely speculative bet’ and only 6% agreed that cryptocurrencies were ‘a safe investment that I don’t have to worry about’.

In contrast, one third of gold investors in the survey viewed their gold investment as either ‘a store of value (to protect my wealth)’, a way to ‘protect against inflation’ or as ‘a safe investment that I don’t have to worry about’.

Given that late 2021 was the peak of the Bitcoin and crypto price cycle, this divergence of views between gold and crypto is surely even more stark now that the Gallup 2023 survey is indicating that six times more of the American public think gold, and not crypto, is the best long-term investment.

Gold Demand Trends – USA

For corraboration that the large jump in gold’s showing in the April 2023 Gallup survey is not some statistical abnormality, we can turn to the World Gold Council’s (WGC) Gold Demand Trends (GDT) report for Q1 2023, which very much reinforces the finding that 26% of Americans now think gold is the best long-term investment (against 15% just a year ago in April 2022).

According to the WGC Q1 GDT 2023 report:

“The banking failure in March lit a fuse under US bar and coin investors, who piled into gold.”

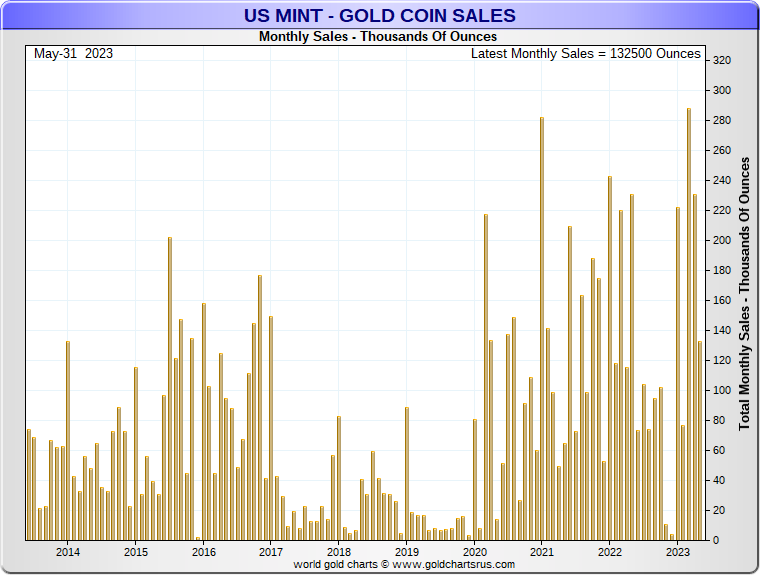

“US bar and coin demand jumped 40% quarter on quarter , a 4% year on year increase, to 32 tonnes, the fourth strongest quarter in our data series and the highest since 2010. This was almost double the five-year average of 17 tonnes.”

“The higher gold price continued to stoke interest in gold, although initially at a more measured pace than in recent quarters. The market burst into life in March as the collapse of SVB and Signature Bank put gold squarely in the spotlight.

The US Mint reported rocketing coin sales, which reached 288,000 ounces in March – the biggest monthly total since October 1998, when the Y2K safe-haven rush for gold was in full swing.

Demand remains healthy amid continued fears about the health of the banking sector, as well as concern around the forthcoming domestic debt ceiling negotiations and more general elevated global geopolitical tensions.

Higher premiums on silver products are also reportedly supporting some substitution into gold.”

You can see this multi-year high US Mint gold bullion coin sales total for March 2023 on the following chart. US Mint gold bullion coins include US Mint American Gold Eagles and US Mint American Gold Buffalos:

Conclusion

Back in August 2011 when Gallup first added gold to its list of asset classes in the survey question about ‘best long-term investment’, gold actually trumped all other asset classes when a huge 34% of respondents preceived that gold was the best long term investment. This was around about the time in August – September 2011 when gold reached a then all time high of US$ 1900.

As the time Gallup wrote that:

“The Aug. 11-14 Gallup poll was conducted at the end of a tumultuous week on Wall Street that sent the price of gold soaring."

“Gold is Americans’ top pick as the best long-term investment regardless of gender, age, income, or party ID, but men, seniors, middle-income Americans, and Republicans are more enamored with it than are other Americans."

Gallup cotinued that:

“Traditionally, gold — like the U.S. dollar — has been a safe haven in times of economic and political turmoil. It is a globally accepted store of value and one of the most highly desired precious metals.

The demand for gold has soared in recent years, as the financial crisis engulfed the global banking industry. More recently, the efforts of nations around the world and their monetary authorities to stimulate the global economy and avoid a repeat of the 1930s have made gold even more attractive.

Current sovereign debt problems have only added to the demand for gold."

Sounds familar? Even though those paragraphs were written 12 years ago, they could just as easily have been written today, since none of the problems in the US economy, nor in the global economy, has been fixed compared to 2011.

In fact, the build-up of a super financial crisis has only been postponed and kicked down the road by the US Fed,US Treasury and Congress. And with a potential US banking crisis now on the horizon in conjunction with ever persistent inflation and a possible US recession, there has never been a better time to own physical gold. A quarter of the US adult population think likewise. And maybe the other three quarters will in time follow suit.

Following our launch in the United States, BullionStar US is offering a selection of precious gold and silver investment bars and coins at extremely competitive prices, likely to be the best bullion prices in the United States. Shipping, insurance and handling are completely FREE to anywhere in the Unite States for all orders above USD 98!

If you choose to buy and store your gold and silver in BullionStar’s precious metals vault in Texas, all precious metals purchase orders for US vault storage will receive the first year of vault storage absolutely free.

Opening a BullionStar account is quick and easy and can be completed in just a few minutes here.

Popular Blog Posts by Ronan Manly

How Many Silver Bars Are in the LBMA's London Vaults?

How Many Silver Bars Are in the LBMA's London Vaults?

ECB Gold Stored in 5 Locations, Won't Disclose Gold Bar List

ECB Gold Stored in 5 Locations, Won't Disclose Gold Bar List

German Government Escalates War On Gold

German Government Escalates War On Gold

Polish Central Bank Airlifts 8,000 Gold Bars From London

Polish Central Bank Airlifts 8,000 Gold Bars From London

Quantum Leap as ABN AMRO Questions Gold Price Discovery

Quantum Leap as ABN AMRO Questions Gold Price Discovery

How Militaries Use Gold Coins as Emergency Money

How Militaries Use Gold Coins as Emergency Money

JP Morgan's Nowak Charged With Rigging Precious Metals

JP Morgan's Nowak Charged With Rigging Precious Metals

Hungary Announces 10-Fold Jump in Gold Reserves

Hungary Announces 10-Fold Jump in Gold Reserves

Planned in Advance by Central Banks: a 2020 System Reset

Planned in Advance by Central Banks: a 2020 System Reset

China’s Golden Gateway: How the SGE’s Hong Kong Vault will shake up global gold markets

China’s Golden Gateway: How the SGE’s Hong Kong Vault will shake up global gold markets

Ronan Manly

Ronan Manly 0 Comments

0 Comments